Port Washington, NY, June 16, 2020 – The unprecedented growth trend for U.S. cycling sales that began in March accelerated even further in April, according to The NPD Group. April sales for traditional bikes, indoor bikes, parts, helmets, and other accessories grew a combined 75% to $1 billion compared to last year. This is the first month since NPD began tracking the cycling market that sales have reached $1 billion in a single month. Typically, April sales fall between $550 and $575 million.

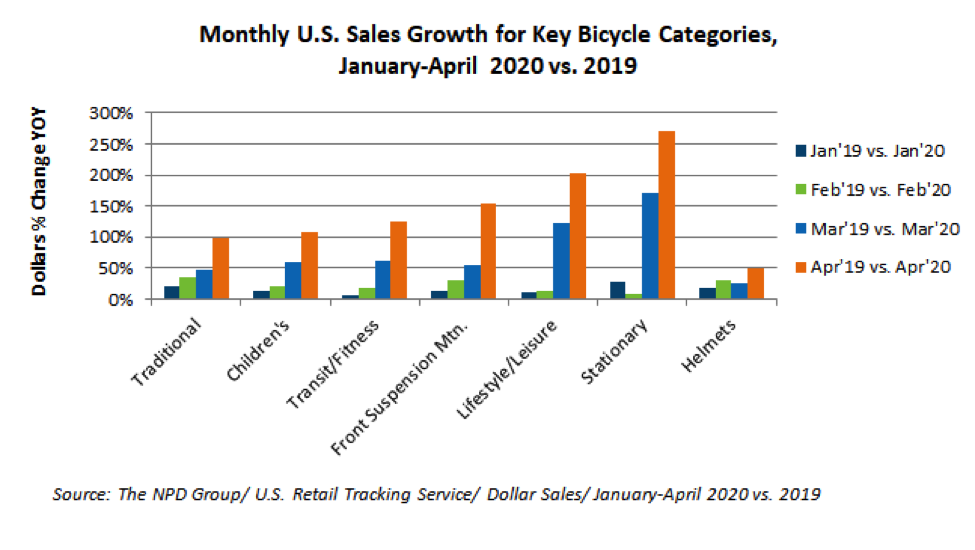

Bicycles suitable for family use, neighborhood riding, and those with more approachable price-points showed the strongest year-over-year sales gains. Lifestyle/leisure bikes, which are more basic adult bicycles sold at prices under $200, grew by 203%; front suspension mountain bikes were up by more than 150%; and children’s bikes increased by 107% for the month. Accessories sales also grew, including helmets (+49%), water bottle cages (+60%), and bike baskets (+85%).

“For far too long the cycling industry has been solely focused on the pinnacle athlete, but these results show that a broader, family and beginner focus can reap gains. This is a silver lining, and one of the important sports retail lessons to come out of the pandemic,” said Matt Powell, NPD’s sports industry advisor.

Another trend that emerged in March and amplified in April was the purchase of cycling equipment for indoor riding. Stationary bike sales grew by 270% for the month, with April sales the second-highest that NPD currently has on record. Trainers and rollers, which allow bikers to mount their current bicycles and ride indoors, experienced a growth rate of 415%.

“The excitement that consumers are showing in cycling, particularly in recreational and family riding, is an absolutely amazing moment for the bike community. This is a unique and powerful chance for retailers, manufacturers, and non-profit organizations to engage new riders,” said Dirk Sorenson, sports industry analyst at NPD. “Continued growth will require them not only to have product in stock, but to focus on new riders’ basic needs such as how to fix a flat tire, or locating a family-friendly trail to ride. Addressing these basics right now has immeasurable ROI, and the industry should be laser-focused on servicing these new riders.”